– Funding to help in acceleration of economic progress, scientific teaching programs, and product improvement enhancements for highly-differentiated OptiMesh® implant portfolio –

ST. PAUL, Minn., August 6, 2024–(BUSINESS WIRE)–Spineology, the medical gadget firm pioneering Conform and Develop™ spinal fusion know-how, at this time introduced that it has raised $25 million in Sequence AA financing led by SV Health Traders, with participation from 1315 Capital and its present investor, RC Capital.

“We’re thrilled to welcome SV Health Traders and 1315 Capital. This infusion of capital permits us to offer our providing extra quickly to sufferers and scientific applications throughout the nation,” stated Brian Snider, Spineology Chief Government Officer. “OptiMesh’s highly effective distraction forces and conformance to the endplates present power and stability to revive disc peak, obtain alignment objectives, and promote sturdy fusion. It’s evident that surgeons and sufferers need much less disruptive choices to deal with spinal issues, additional accelerating our alternative.”

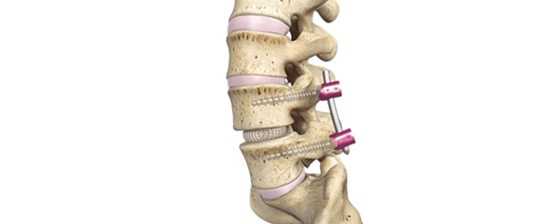

Right now, roughly 400,000 lumbar interbody fusion procedures are carried out in the USA yearly. The OptiMesh know-how is the one in situ affected person particular, expandable implant available on the market. OptiMesh is delivered by way of the smallest insertion portal within the lumbar interbody market, and dynamically conforms to a affected person’s distinctive endplate morphology, increasing to one of many largest implant footprints obtainable. With unparalleled versatility, a single implant could also be used for a number of lumbar fusion approaches accommodating the wants of every affected person. Consequently, this implant, delivered by way of an ultra-minimally invasive strategy, is designed to offer sufferers with quicker post-operative therapeutic, and return to a top quality of life. OptiMesh is backed with Investigational gadget exemption (IDE) stage knowledge and holds the one De Novo Grant for spinal fusion.

“SV Health is happy to again this management group with deep spine expertise, market insights, and a confirmed observe report of success,” stated Greg Madden, Managing Companion, SV Health Traders who now joins the Spineology Board of Administrators.

“Spineology’s OptiMesh know-how is disrupting the business for the higher. Backed with IDE stage knowledge, that is an implant class of its personal. We stay up for super progress forward bringing this distinctive providing to extra hospitals and surgical procedure facilities within the U.S.,” commented Tom Patton, Government Chairman, Spineology.

Distinctive in design and in printed knowledge, OptiMesh holds the very best achievement in scientific validation with an IDE stage grant. Moreover, greater than 20 years of scientific expertise, 20 scientific publications, and greater than 50,000 procedures distinguish OptiMesh within the interbody fusion house.

About Spineology

Spineology Inc. leads the way in which in ultra-minimally invasive spine surgical procedure, revolutionizing how surgeons deal with sufferers with spinal pathologies. Its proprietary know-how, OptiMesh units the corporate aside from conventional fusion procedures enabling surgeons to optimize outcomes, whereas minimizing tissue disruption and enhancing affected person restoration. With a robust dedication to patient-centered care, Spineology aspires to offer each spine affected person the liberty from ache by way of the creation and supply of ultra-MIS options.

For extra details about Spineology, go to Spineology.com, and observe us on Twitter or LinkedIn.

About SV Health Traders

SV Health Traders (“SVHI”) is a non-public funding agency devoted to investments within the healthcare and life sciences sectors. Based in 1993 with places of work in Boston and London, SVHI manages over $2 billion throughout a number of funding methods. SVHI’s devoted healthcare progress fund seeks to companion with skilled administration groups to speed up the success of revolutionary healthcare firms in tech-enabled healthcare providers, medical merchandise and digital well being sectors.

For extra info, please go to www.svhealthinvestors.com.

About 1315 Capital

1315 Capital is a non-public funding agency with over $1 billion in property underneath administration that gives progress capital to commercial-stage healthcare providers, pharmaceutical & medical know-how outsourcing, medical know-how, and well being & wellness firms. 1315 Capital targets each minority and majority investments in firms the place high-quality administration groups can quickly scale platform firms into giant and necessary companies that positively impression sufferers, physicians, and the broader healthcare system.

For extra info, please go to www.1315capital.com.

Contacts

Jamison Younger

Chief Monetary Officer

651-256-8504

jyoung@spineology.com