BURLINGTON, Mass., August 2, 2024–(BUSINESS WIRE)–Bone Biologics Company (“Bone Biologics” or the “Firm”) (Nasdaq: BBLG, BBLGW), a developer of orthobiologic merchandise for spine fusion markets, immediately introduced that it has entered right into a definitive settlement for the train of sure current warrants to buy an combination of 781,251 shares of its frequent inventory having an train worth of $2.43 per share, initially issued in March 2024. The issuance of the shares of frequent inventory issuable upon train of the present warrants is registered pursuant to an efficient registration assertion on Kind S-1 (File No. 333-276771).

H.C. Wainwright & Co. is performing because the unique placement agent for the providing.

In consideration for the instant train of the present warrants for money and the cost of $0.125 per new warrant, the Firm will subject new unregistered warrants to buy as much as an combination of 1,562,502 shares of frequent inventory (the “new warrants”). The brand new warrants will probably be instantly exercisable at an train worth of $2.00 per share. New warrants to buy 781,251 shares of frequent inventory may have a time period of 5 years from the issuance date, and new warrants to buy 781,251 shares of frequent inventory may have a time period of eighteen months from the issuance date.

The providing is predicted to shut on or about August 2, 2024, topic to satisfaction of customary closing situations. The gross proceeds to the Firm from the train of the present warrants and the issuance of latest warrants are anticipated to be roughly $2.1 million, previous to deducting placement agent charges and estimated providing bills payable by the Firm. The Firm intends to make use of the online proceeds from the providing to fund scientific trials, keep and lengthen its patent portfolio, and for working capital and different normal company functions.

The brand new warrants described above are being provided in a non-public placement below Part 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Regulation D promulgated thereunder and, together with the shares of frequent inventory issuable upon train of the brand new warrants, haven’t been registered below the Securities Act, or relevant state securities legal guidelines. Accordingly, the brand new warrants issued within the personal placement and the shares of frequent inventory underlying the brand new warrants will not be provided or bought in america besides pursuant to an efficient registration assertion or an relevant exemption from the registration necessities of the Securities Act and such relevant state securities legal guidelines. The Firm has agreed to file a registration assertion with the Securities and Trade Fee overlaying the resale of the shares of frequent inventory issuable upon the train of the brand new warrants.

This press launch doesn’t represent a suggestion to promote or a solicitation of a suggestion to purchase these securities, nor shall there be any sale of those securities in any state or different jurisdiction wherein such provide, solicitation or sale could be illegal previous to the registration or qualification below the securities legal guidelines of any such state or different jurisdiction.

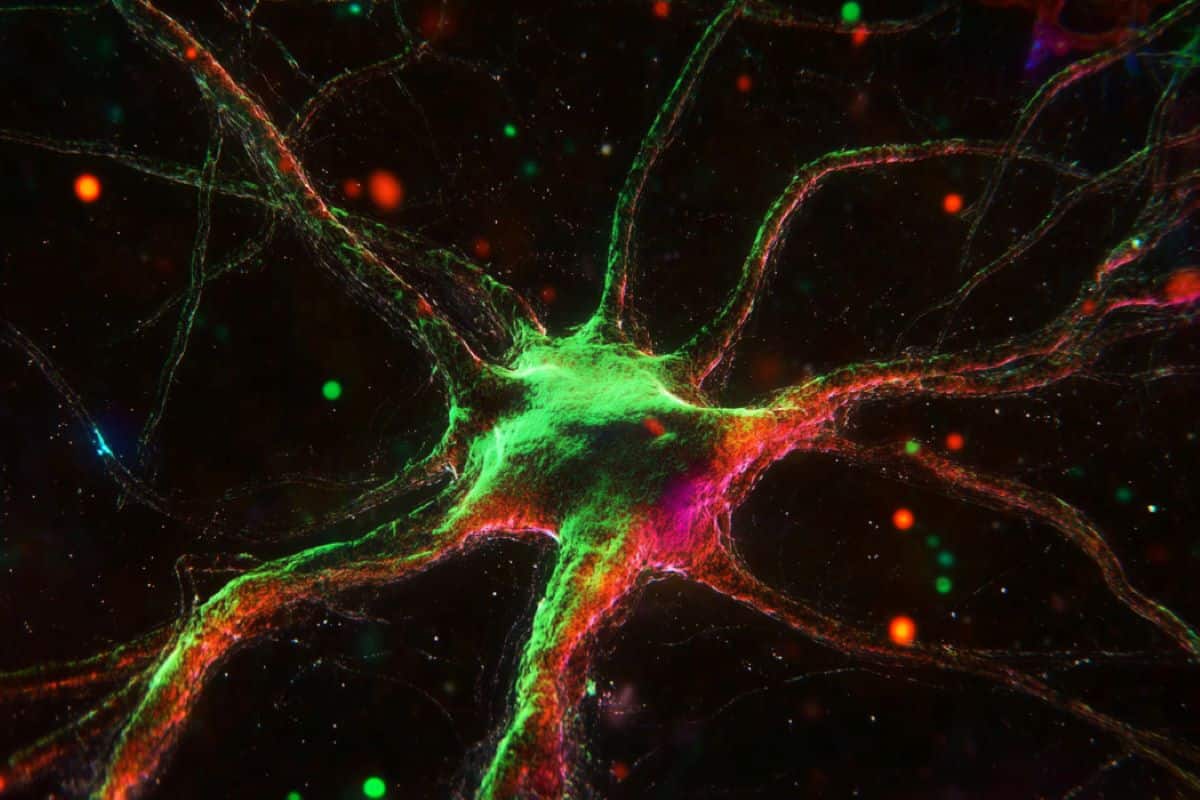

About Bone Biologics

Bone Biologics was based to pursue regenerative drugs for bone. The Firm is enterprise work with choose strategic companions that builds on the preclinical analysis of the NELL-1 protein. Bone Biologics is focusing growth efforts for its bone graft substitute product on bone regeneration in spinal fusion procedures, whereas moreover having rights to trauma and osteoporosis purposes. For extra info, please go to www.bonebiologics.com.

Ahead-Trying Statements

Sure statements contained on this press launch, together with, with out limitation, statements concerning the completion of the providing, the satisfaction of customary closing situations associated to the providing and the meant use of proceeds therefrom, in addition to the timing, implementation, and success of the Firm’s pilot scientific examine, the power of the Firm’s lead product candidate NB1 to supply speedy, particular and guided management over bone regeneration and present fusion success in people, the power of NB1 to compete in world markets, in addition to statements containing the phrases “will,” “anticipate,” “intend,” “might,” and phrases of comparable import, represent “forward-looking statements” inside the that means of the Personal Securities Litigation Reform Act of 1995. Such forward-looking statements contain each identified and unknown dangers and uncertainties. The Firm’s precise outcomes might differ materially from these contained in its forward-looking statements because of quite a few components, together with, however not restricted to, market and different situations and dangers usually related to an undercapitalized creating firm, in addition to the dangers contained below “Threat Elements” and “Administration’s Dialogue and Evaluation of Monetary Situation and Outcomes of Operations” within the Firm’s Annual Report on Kind 10-Ok for the 12 months ended December 31, 2023 and the Firm’s different filings with the Securities and Trade Fee. Besides as required by relevant regulation, the Firm undertakes no obligation to revise or replace any forward-looking statements to mirror any occasion or circumstance that will come up after the date hereof.

Contacts

LHA Investor Relations

Kim Sutton Golodetz

212-838-3777

kgolodetz@lhai.com

Discussion about this post